Here’s how to calculate your workers’ compensation premium

Workers’ compensation pays out medical costs and lost wages when your employees develop a work-related injury, illness, or other impairment as a direct result of their job. It’s required by law in most states. Financial relief under this policy could range from supplementary lost income over a number of weeks to permanent total disability benefits for decades to come.

But how do insurers calculate your policy rates and make sure you’re paying into a plan that makes sense for your small business?

First, let’s look at the factors that affect your workers’ compensation rate:

1. The size of your payroll.

This is, by far, the most significant factor. The bigger your payroll, the more you’ll pay for workers’ compensation.

It makes sense, too. The more employees you have, the more likely it is, statistically, that one of them will suffer a work-related injury or illness. And the more money your employees make, the more money your insurer could have to pay out when one of them is injured.

That’s why total payroll is always the starting point in calculating your workers’ compensation premium. For example, the average cost for workers’ compensation in California is about $3 per $100 of employee payroll.

But that rate will fluctuate based on...

2. The kind of jobs your employees do. (Manual Rate)

Some jobs are riskier than other jobs (think working on a crane truck vs. working an office job), and you’ll pay a higher percentage of your payroll to get workers’ compensation insurance for those kinds of jobs.

That’s why, when you apply for workers’ compensation, your insurer will ask what kind of work your employees do. They’ll use that information to determine the correct classification code for your business. These three or four digit codes are what insurers use to decide how risky a company is to insure. If your employees work riskier jobs, you might need to pay $4-$5 dollars or more per $100 of payroll to get workers’ compensation. Less risky jobs will mean a lower premium. It’s pretty simple.

3. The location of your business.

The cost of living and medical expenses varies based on geographic location. For example, if your business is based in an area with higher medical costs, you can expect to pay a little more in workers’ compensation simply because the claim cost is higher.

4. Your company’s safety record. (Experience Modification Rate)

This is good news for conscientious employers. If your business has been around for a while without reporting a single injury, your insurance company will pay attention to that—and a better safety record might mean a lower premium.

If your business is on the larger side, your safety record might be quantified into a number called the Experience Modification Rate (it’s also sometimes shortened to EMR or, simply, the experience mod or x-mod). That number is based on a bunch of factors, but it mostly has to do with how safe your company is compared with other companies in your industry. The average experience mod number is 1. If you have a fantastic safety record, you’ll get a number less than 1. If you’ve had a workers’ compensation claim (or ten!), you may get a number that’s higher.

By the way, it’s important to know that newer businesses don’t always qualify for an EMR right away. It is based on a few factors such as generated payroll amount, the industry you are in and expected losses.

5. Various other factors. (Schedule Rating)

After your insurer has looked at your payroll, location, industry, and safety record, they’ll likely tweak your rate based on some comparatively small factors—this part of the process is called the schedule rating. The insurer will make adjustments based on any special risks associated with your business, your company’s use of safety equipment, your strategy for employee safety training, and your overall attitude toward safety. Each adjustment could make your rate higher (a surcharge) or lower (a discount).

That’s one more reason to make sure you’ve got a solid safety program at your small business: Insurance companies do pay attention.

Are there any other factors that affect your rate?

Yep. You’re going to see some standard charges on your final rate.

One is called the Expense Constant, and it basically compensates your insurance company for the cost of administering your policy—every workers’ compensation policy has one. You might also see a few miscellaneous fees that are required by law (such as the state surcharge or terrorism surcharge).

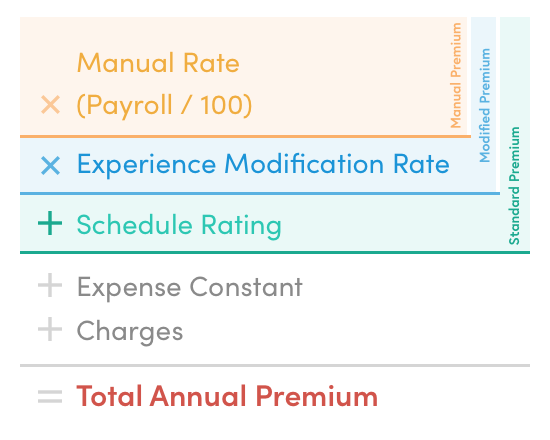

And that’s pretty much it. Those are the factors which affect your workers’ compensation rate. The simplified formula looks something like this:

But that’s just a formula. Let’s look at how all this works in the real world.

An example workers’ compensation calculation

Let’s say you run a landscaping company and are shopping around for a better price on your workers’ compensation policy (never a bad idea!). To calculate a workers’ compensation rate for your business, an insurer will start by finding your class code—the numeric code which indicates the kind of work your employees do (which will dictate your base workers’ compensation Manual Rate).

In this case, the numeric code applied to your business is #0042 - Landscaping worker—and let’s say it comes with a base rate of $5 per $100 of taxable payroll. For simplicity’s sake, we’ll assume your projected taxable payroll for the year will be exactly $100,000.

Let’s look at what we have so far:

| ($100,000/100)x5 | = | $5,000 |

| Total Manual Premium | = | $5,000 |

Now the insurance company has your starting rate (called a Manual Premium), so it’s time to get into the details—the schedule rating. (Note: If your company is eligible for an Experience Modification Rate, they’d apply that multiplier right now. But since most small companies don’t get an EMR right away, we’ll leave it out of this calculation.)

In this case, after applying the various credits and debits of your schedule rating, it looks like your rate will be $300 less expensive. Nice.

| Total Manual Premium | = | $5,000 |

| Schedule Rating | – | $300 |

| Standard Premium | = | $4,700 |

Finally, the insurer will factor in their expenses plus any other charges required by law (we’ll include an abbreviated list).

| Standard Premium | = | $4,700 | ||

| Expense Constant | + | $250 | ||

| Subsequent Injury Fund | + | $13 | ||

| Terrorism | + | $6 | ||

| Fraud Surcharge | + | $9 | ||

| Total Annual Premium | = | $4,978 |

And that wraps it up. In this sample case, the rate to insure your landscaping business would be about $415 per month. Not bad—and certainly less than the cost of an injury lawsuit (which can run into the millions of dollars).

Conveniently, you don’t ever have to do this math yourself. Especially if you take a moment to try out our workers’ compensation calculator above—it can calculate your starting rate in about 60 seconds.

Workers’ compensation premiums in the United States

Want to get a sense of what you might pay for workers’ compensation from Huckleberry? Here are the lowest rates our customers have paid across the country:

Get an instant estimate by using our workers’ compensation calculator

Don't take our word for it

Get a quote in five minutes.

Everything's online. Everything's easy. Tap the button to get started.